Are you thinking about buying a new home in Fort Bend County? Fulbrook on Fulshear Creek is a...

Property Taxes in Fulshear Comparison

Thinking about buying a new home? Texas can be notorious for high property taxes especially in particularly desirable neighborhoods, however Fulshear seems to be the exception to this rule. These quaint residential neighborhoods seem to be Fort Bend county's best-kept secret.

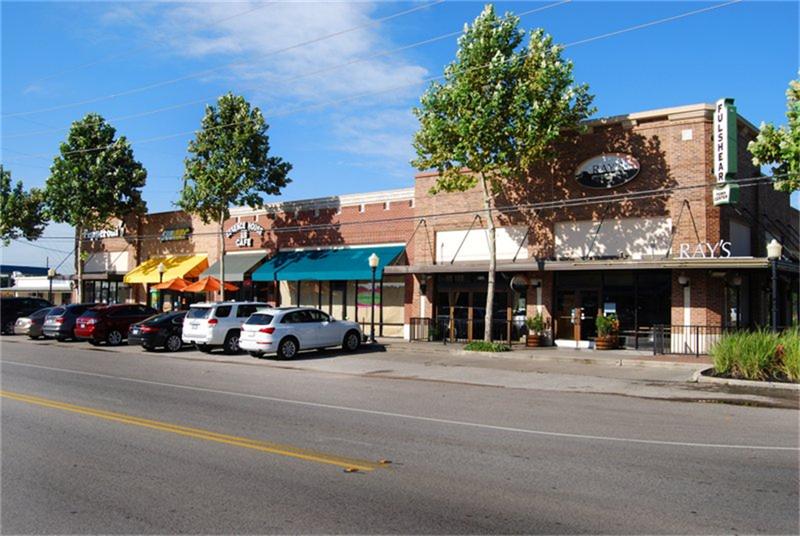

Fulshear retains a small-town charm and peaceful atmosphere without sacrificing affordability. Residents can live in their dream homes without the painfully high property taxes of neighboring towns and counties.

While the average town in Fort Bend collects a property tax of 47 cents for every 100$ of property value, Fulshear's property tax is only 16 cents per $100. Many adjacent towns have even higher property taxes: Missouri City collects 53 cents and Sugar Land collects 32 cents per $100. Even citizens of the town of the Woodlands, on the North side of Houston and outside Fort Bend, still have to pay 23 cents per $100 of property, (without the advantages of Fulshear's ample amenities, art programs, and high-quality schools).

One county over, prices remain high: Harris County imposes an average property tax of 42 cents per 100$.

Because Fulshear is nestled amongst towns with much higher property taxes, it benefits secondarily from the service those funds provide. The county as a whole, because of its high average property tax, has amply funded roads, schools, streets, police and fire departments. This means that the neighborhoods around Fulshear are thriving, safe and well taken care of, at no added cost to Fulshear citizens.

With historic beauty, convenient location, and beautiful, affordable homes, Fulshear may very well be a little piece of Heaven in Texas.